UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Noodles & Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

April 18, 2017March 19, 2020

To Our Stockholders:

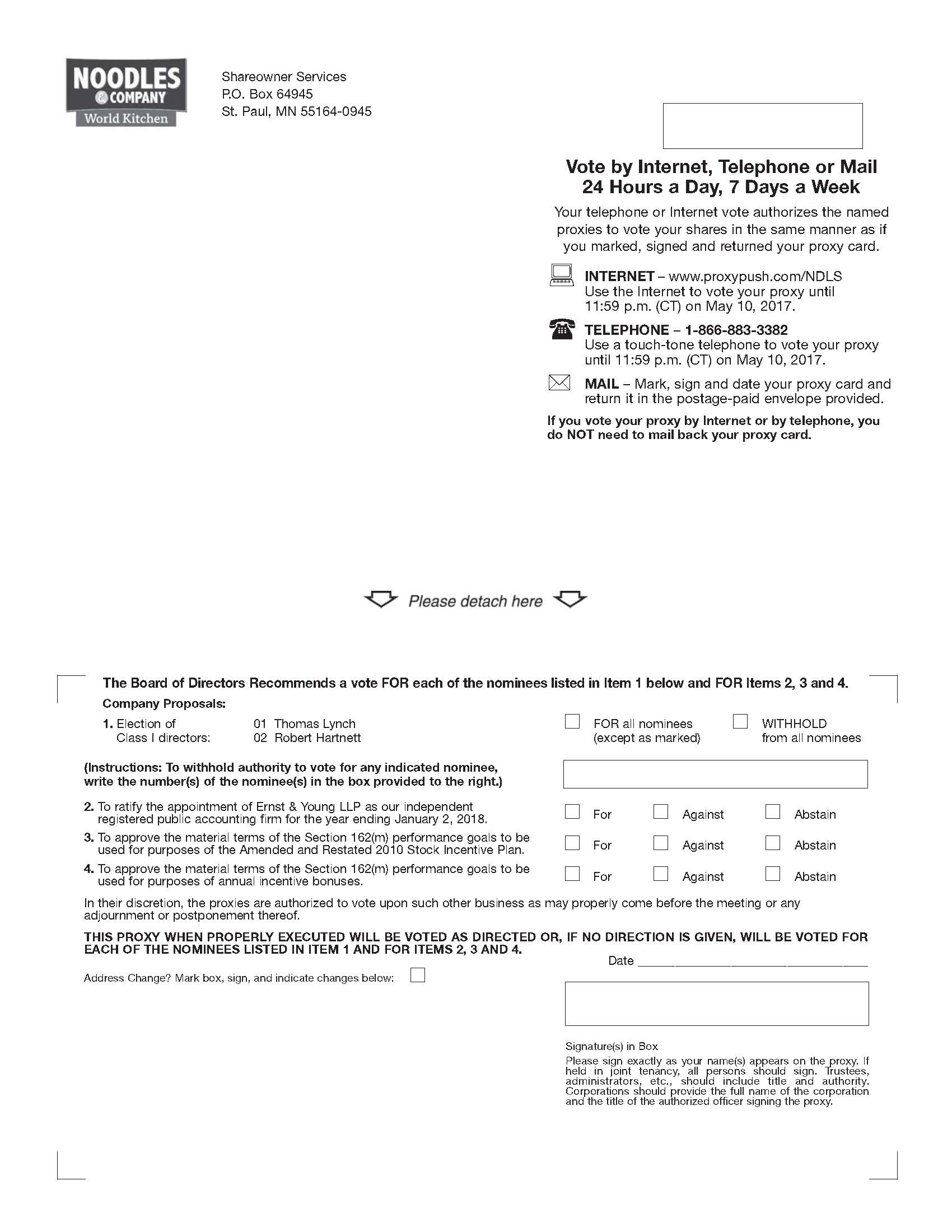

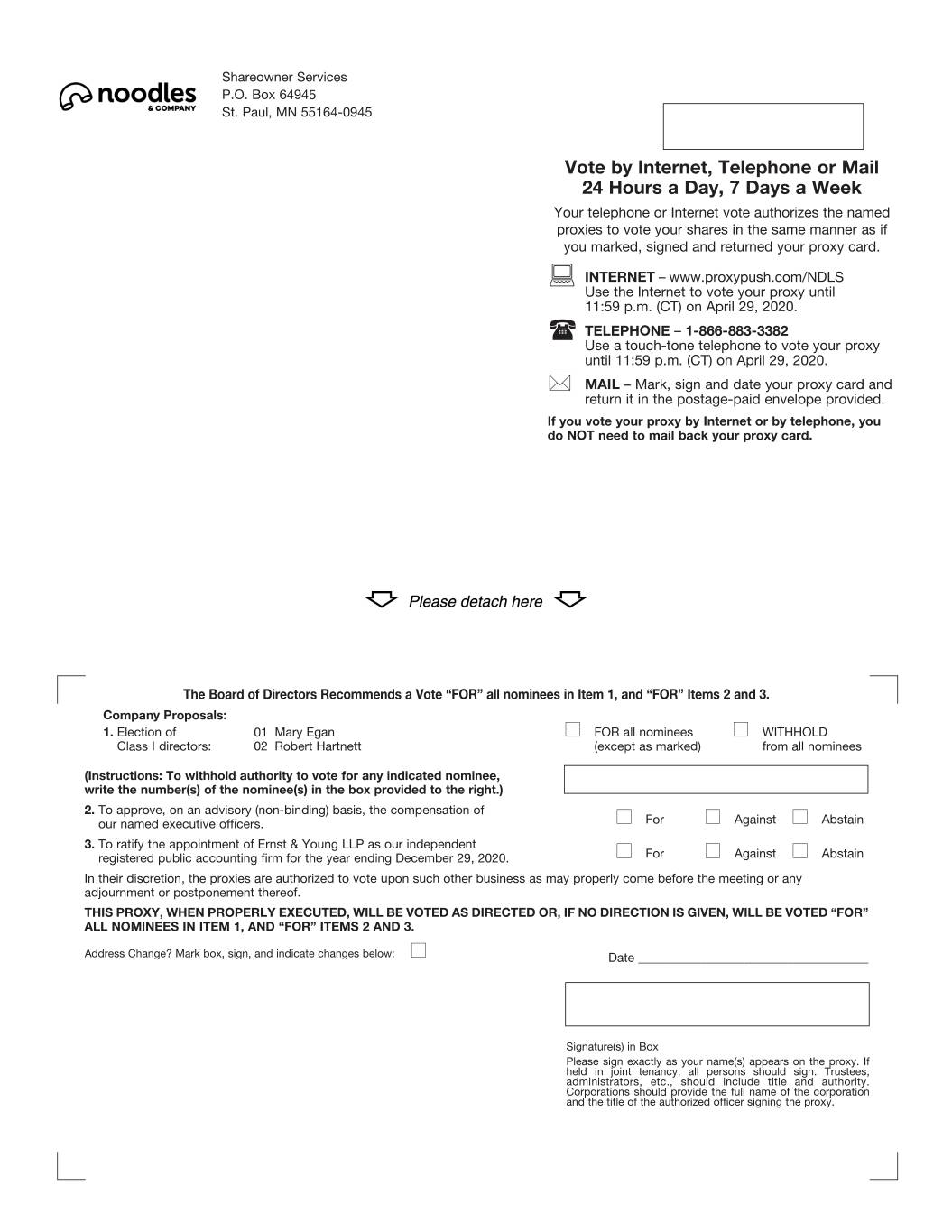

You are cordially invited to attend the 20172020 Annual Meeting of Stockholders of Noodles & Company at the offices of the Company at 520 Zang Street, Suite D, Broomfield, Colorado, on May 11, 2017,April 30, 2020, at 10:1:00 a.m.p.m. local time.

The matters expected to be acted upon at the meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Please cast your vote as soon as possible over the Internet, by telephone, or, if you received a paper copy of the proxy materials, by completing and returning the enclosed proxy card in the postage-prepaid envelope so that your shares are represented. Your vote will mean that you are represented at the Annual Meeting regardless of whether or not you attend in person. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to seeing you at the meeting.

Sincerely,

Dave Boennighausen

Interim Chief Executive Officer and Chief Financial Officer

NOODLES & COMPANY

520 ZANG STREET, SUITE D

BROOMFIELD, COLORADO 80021

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 20172020 Annual Meeting of Stockholders of Noodles & Company (the “Company”) will be held at the offices of the Company at 520 Zang Street, Suite D, Broomfield, Colorado, on May 11, 2017,April 30, 2020, at 10:1:00 a.m.p.m. local time, for the following purposes:

1. To elect the two directors named in the Proxy Statement as Class I directors of Noodles & Company, each to serve for three years and until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal.

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending January 2, 2018.

3. To approve the material terms of the performance goals pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), to be used for purposes of the Company’s Amended and Restated 2010 Stock Incentive Plan.

4. To approve the material terms of the performance goals pursuant to Section 162(m) of the Code to be used for purposes of the Company’s annual incentive bonus arrangements.

5. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

| |

| 1. | To elect the two directors named in the Proxy Statement as Class I directors of the Company, each to serve for three years and until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal. |

| |

| 2. | To approve, on an advisory (non-binding) basis, the compensation of our named executive officers. |

| |

| 3. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 29, 2020. |

| |

| 4. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on March 13, 20173, 2020 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. We expect to mail a notice of Internet availability of proxy materials (which include this Proxy Statement, proxy card and our 2016 Annual Report)(the “Notice”) to our stockholders on or about April 18, 2017.March 19, 2020. The Notice contains instructions on how to access our proxy materials over the Internet and how to vote by going to a secure website. If you did not receive such a Notice, you may elect to receive future notices, proxy materials and annual reports electronically through the Internet by following the instructions in this Proxy Statement.

By Order of the Board of Directors

Paul A. Strasen,Melissa Heidman,

Executive Vice President,

General Counsel & Secretary

Broomfield, Colorado

April 18, 2017March 19, 2020

Whether or not you expect to attend the meeting, please vote via the Internet, by telephone, or, if you received a paper copy of the proxy materials, by completing, dating, signing and promptly returning the accompanying proxy card in the enclosed postage-paid envelope so that your shares may be represented at the meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON MAY 11, 2017:APRIL 30, 2020:

THIS PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT

www.proxypush.com/NDLS

Noodles & Company

Proxy Statement

For the Annual Meeting of Stockholders

To Be Held on May 11, 2017April 30, 2020

TABLE OF CONTENTS

NOODLES & COMPANY

520 ZANG STREET, SUITE D, BROOMFIELD, COLORADO 80021

PROXY STATEMENT

April 18, 2017March 19, 2020

THE MEETING

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Noodles & Company, a Delaware corporation (the “Company”), for use at the 20172020 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the offices of the Company at 520 Zang Street, Suite D, Broomfield, Colorado, on May 11, 2017,April 30, 2020, at 10:1:00 a.m.p.m. local time. The Notice, the Proxy Statement, the form of proxy and the Annual Report were first mailedmade available to stockholders on or about April 18, 2017.March 19, 2020. Electronic copies of this Proxy Statement, form of proxy and Annual Report are available at investor.noodles.com and www.proxypush.com/NDLS.

Voting Rights, Quorum and Required Vote

Only holders of record of our Class A and Class B common stock (“common stock”) at the close of business on March 13, 2017,3, 2020, which is the record date, will be entitled to vote at the Annual Meeting. At the close of business on March 13, 2017,3, 2020, we had 27,872,92544,144,688 shares of Class A common stock outstanding and entitled to vote,vote. There are currently no shares of which 26,350,827 were Class A Common Stock and 1,522,098 were Class B Common Stock. Holders of the Company’s Class A and Class B common stock are entitled to one vote for each share held as of the above record date, with the exception that Class B common stock does not voteoutstanding and none were outstanding on the election or removal of directors. Shares of our Class B common stock are convertible on a share-for-share basis into shares of our Class A common stock at the election of the holder. As of the close of business on March 13, 2017, we also had outstanding 18,500 shares of Series A convertible preferred stock (the “Preferred Stock”), which shares are convertible into 4,252,873 shares of Class A common stock. The outstanding shares of Preferred Stock are entitled to vote on an as-converted basis with the holders of our common stock on the matters submitted to a vote of holders of our common stock. On April 12, 2017, 18,500 shares of Preferred Stock were converted into 4,252,873 shares of Class A common stock. Each stockholder may appoint only one proxy holder or representative to attend the meeting on his or her behalf.record date. A quorum is required for our stockholders to conduct business at the Annual Meeting. The holders of a majority in voting power of all issued and outstanding stock entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum for the transaction of business. Abstentions and “broker non-votes” (described below) will be counted in determining whether there is a quorum.

Proposal No. 1—Election of Directors—directors will be elected by a plurality of the votes of the shares of common stock cast at the Annual Meeting, which means that the two nominees receiving the highest number of “for” votes will be elected. Withheld votes and broker non-votes (as defined below) will have no effect on this Proposal No. 1.

Proposal No. 2—RatificationApproval, on an Advisory (Non-Binding) Basis, of Appointment of Independent Registered Public Accounting Firm—our Named Executive Officers’ Compensation—requires the affirmative vote of the holders of a majority in voting power of the stock entitled to vote at the Annual Meeting, present in person or represented by proxy. Abstentions will count the same as votes against Proposal No. 2. Since this is a “routine” proposal, there should beBroker non-votes will have no broker non-votes with respect toeffect on this Proposal No. 2.

Proposal No. 3—ApprovalRatification of Material TermsAppointment of Independent Registered Public Accounting Firm for the Section 162(m) Performance Goals to be used for purposes of the Company’s Amended and Restated 2010 Stock Incentive Plan—Year Ending December 29, 2020—requires the affirmative vote of the holders of a majority in voting power of the stock entitled to vote at the Annual Meeting, present in person or represented by proxy. Abstentions will count the same as votes against this Proposal No. 3. BrokerSince this is a “routine” proposal, there should be no broker non-votes will have no effect onwith respect to this Proposal No. 3.

Proposal No. 4—ApprovalInternet Availability of Material TermsProxy Materials

We have adopted a procedure approved by the Securities and Exchange Commission (“SEC”) that permits companies to furnish their proxy materials over the Internet. As a result, we are mailing the Notice instead of a paper copy of the Performance Goals Pursuantproxy materials. All stockholders receiving the Notice will have the ability to Section 162(m)access the proxy materials over the Internet and may request to receive a paper copy of the Codeproxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be used for purposes offound in the Company’s Annual Incentive Bonus Arrangements—requiresNotice. In addition, the affirmative vote of the holders of a majorityNotice contains information on how you may request access to proxy materials in voting power of the stock entitled to vote at the Annual Meeting, present in personprinted form by mail or represented by proxy. Abstentions will count the same as votes against Proposal No. 4. Broker non-votes will have no effectelectronically on Proposal No. 4.an ongoing basis.

Voting Your Shares

If you are a registered holder, meaning that you hold our stock directly (not through a bank, broker or other nominee), you may vote in person at the Annual Meeting, via telephone, or electronically through the Internet by following the instructions included in the Notice or the proxy card, as applicable, or, if you receive a paper copy of the proxy materials, by completing, dating and signing the accompanying proxy card and promptly returning it in the enclosed envelope. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. Signed proxies that give no instructions as to how they should be voted on a particular proposal at the Annual Meeting will be counted in accordance with the Board’s recommendations as follows: as votes “for” such proposal orProposal No. 2 and Proposal No. 3 and, in the case of the election of the Class I directors, as a vote “for” election to Class I of the Board of each of the nominees presented by the Board.Board in Proposal No. 1.

If your shares are held through a bank, broker or other nominee, you are considered the beneficial owner of those shares. You may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that nominee. You must obtain a legal proxy from the nominee that holds your shares if you wish to vote in person at the Annual Meeting. If you do not provide your broker with a properly executed voting instructions to your brokerform in advance of the Annual Meeting, New York Stock Exchange rules grant your broker discretionary authority to vote only on “routine” proposals. The ratification of the appointment of the independent registered public accounting firm in Proposal No. 23 is the only item on the agenda for the Annual Meeting that is considered routine. Where a proposal is not “routine,” a broker who has received no properly executed voting instructions form from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal, and the unvoted shares are referred to as “broker non-votes.”

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the Chairman of the Annual Meeting may adjourn the Annual Meeting to permit further solicitations of proxies.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. Stockholders voting via the telephone or Internet should understand that there may be costs associated with telephonic or electronic access, such as usage charges from telephone companies and Internet access providers, that must be borne by the stockholder.

Expenses of Solicitation

The expenses of soliciting proxies to be voted at the Annual Meeting will be paid by the Company. Following the original mailing of the Notice, proxies and other soliciting materials, the Company and/or its agents may also solicit proxies in person, by telephone or email. Following the original mailing of the Notice, proxies and other soliciting materials, the Company will request that banks, brokers and other nominees forward copies of the proxy and other soliciting materialsNotice to persons for whom they hold shares of common stock and request authority for the exercise of proxies. We will reimburse banks, brokers and other nominees for reasonable charges and expenses incurred in forwarding soliciting materials to their clients.

Revocability of Proxies

Any person submitting a proxy in the form accompanying this Proxy Statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote. A proxy may be revoked by a writing delivered to the Company stating that the proxy is revoked by a subsequent vote or proxy that is submitted via telephone or Internet, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, or by attendance at the Annual Meeting and voting in person. In order for beneficial owners to change any of your previously provided voting instructions, you must contact your bank, broker or other nominee directly.

Delivery of Documents to Stockholders Sharing an Address

We have adopted a procedure approved by the Securities and Exchange Commission (“SEC”)SEC called “householding” under which multiple stockholders who share the same address will receive only one copy of the Notice, the Annual Report, the Proxy Statement, and the proxy card, unless we receive contrary instructions from one or more of the stockholders. If you wish to opt out of householding and receive multiple copies of the proxy materialsNotice at the same address, or if you have previously opted out and wish to participate in householding, you may do so by notifying us by telephone at 720-214-4132, by mail at Noodles & Company at, 520 Zang Street, Suite D, Broomfield, CO 80021, or by email at investorrelations@noodles.com, and we will promptly deliver the requested materials. You also may request additional copies of the proxy materials by notifying us in writing or by telephone at the same address, email address, or telephone number. Brokerage firms and banks are also entitled to household. Stockholders with shares registered in the name of a brokerage firm or bank should contact their brokerage firm or bank to request information about householding or to opt in or out of householding.

On or about March 19, 2020, we expect to mail or email some of our stockholders the Notice. If you receivedreceive the proxy materials by mailNotice and would likeprefer to receive a copypaper copies of the proxy materials electronically via an e-mail on a going forward basis, please follow the instructions onin the proxy cardNotice (or the voting instructions card provided by your brokerage firm or bank) to request electronic delivery of the proxy materials via e-mail on a going forward basis..

Explanatory Note

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For as long as we are an emerging growth company, we will not be required to provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or obtain stockholder approval of any golden parachute payments not previously approved. In addition, because we are an emerging growth company, we are not required to include a Compensation Discussion and Analysis section in this Proxy Statement and have elected to comply with the scaled-down executive compensation disclosure requirements applicable to emerging growth companies.

We could be an emerging growth company for up to five years from June 28, 2013, the date of our initial public offering, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur at the end of the fiscal year during which the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Under Section 107(b) of the JOBS Act, emerging growth companies may delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we are subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The size of the Company’s Board of Directors is currently fixed at eight members, and the Board of Directors is presently comprised of eightseven members, who are divided into three classes, designated as Class I, Class II and Class III. One class of directors is elected by the stockholders at each annual meeting to serve a three-year term.

James Rand, formerly aEach of the nominees for election to Class I director andis currently a memberdirector of the Audit Committee, resigned from the Board of Directors effective as of April 3, 2017, at which time Thomas Lynch was elected to replace Mr. Rand as a Class I director. In addition, Johanna Murphy, who has served as a member of our Board of Directors since 2014 and whose term expires at this Annual Meeting, has decided not to stand for re-election at this Annual Meeting. We thank Ms. Murphy and Mr. Rand for their years of dedicated service to the Company.

Mr. Lynch is standing for re-election at the Annual Meeting as a Class I director. In addition, in connection with the expiration of Ms. Murphy’s current term at the Annual Meeting, the Board nominated Robert Hartnett to stand for election as a Class I director at the Annual Meeting. Because Mr. Hartnett currently serves as a Class III director, to facilitate his election as a Class I director at the Annual Meeting, Mr. Hartnett notified the Board of his intention to resign as a Class III director effective and contingent upon his election as a Class I director at the Annual Meeting. If Mr. Hartnett is elected as a Class I director at the Annual Meeting, a vacancy will be created by Mr. Hartnett’s resignation as a Class III director. Class II directors consist of Andrew Taub, François Dufresne, and Jeffrey Jones; and Class III directors consist of Dave Boennighausen, Scott Dahnke and Robert Hartnett (who, as discussed above, notified the Board of his intention to resign as a Class III director effective and contingent upon his election as a Class I director at the Annual Meeting). Class II and Class III directors will stand for reelection or election at the 2018 and 2019 annual meetings of stockholders, respectively.

If elected at the Annual Meeting, each of the Class I director nominees would serve for three years expiring at the 20202023 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified, or until such director’s earlier death, resignation or removal. Proxies cannot be voted for a greater number of persons than the number of nominees named. If eitherany of the nominees is unable or unwilling to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), the stockholders may vote for a substitute nominee chosen by the present Board to fill the vacancy. In the alternative, the stockholders may vote for just the remaining nominees, leaving a vacancy that may be filled at a later date by the Board, or the Board may reduce the size of the Board.

The names of the nominees for election as Class I directors at the Annual Meeting and of the incumbent Class II and Class III directors, (other than Mr. Hartnett who is listed as a Class I director nominee), and certain information about them, including their ages, as of April 18, 2017,March 19, 2020, are included below.

| | | | | Class | | Age | | Position | | Year Elected Director | | Current Term Expires | Expiration of Term for which Nominated | | Class | | Age | | Position | | Year Elected Director | | Current Term Expires | | Expiration of Term for which Nominated |

| Nominees | | |

| Thomas Lynch | | I | | 57 | | Director | | 2017 | | 2017 | 2020 | |

Mary Egan (1)(3) | | | I | | 52 | | Director | | 2017 | | 2020 | | 2023 |

Robert Hartnett(1)(2) | | I | | 65 | | Independent Chairman | | 2016 | | 2019 | 2020 | | I | | 68 | | Director | | 2016 | | 2020 | | 2023 |

| | | |

| Continuing Directors | | |

François Dufresne(2)(3) | | II | | 56 | | Director | | 2016 | | 2018 | | |

Jeffrey Jones(2)(4) | | II | | 55 | | Director | | 2013 | | 2018 | | | II | | 58 | | Chairman | | 2013 | | 2021 | |

Drew Madsen (2)(3) | | | II | | 63 | | Director | | 2017 | | 2021 | |

| Andrew Taub | | II | | 48 | | Director | | 2010 | | 2018 | | | II | | 51 | | Director | | 2010 | | 2021 | |

| Dave Boennighausen | | III | | 39 | | Interim Chief Executive Officer, Chief Financial Officer and Director | | 2015 | | 2019 | | | III | | 42 | | Chief Executive Officer and Director | | 2015 | | 2022 | |

Scott Dahnke(2)(3)(4) | | III | | 51 | | Director | | 2011 | | 2019 | | |

| Elisa Schreiber | | | III | | 41 | | Director | | 2019 | | 2022 | |

________________________

| |

| (1) | Member ofServes on the Audit Committee. Ms. Murphy will continue to serve on the Audit Committee until the Annual Meeting. |

| |

| (2) | Member ofServes on the Compensation Committee. |

| |

| (3) | Member ofServes on the Nominating and Corporate Governance Committee. |

| |

| (4) | Lead Independent Director until July 25, 2016.Chairman of the Board of Directors. |

Nominees for Election as Class I Directors

Thomas LynchMary Egan joinedhas been a member of our Board of Directors in April 2017 when Mill Road Capital made an investment in the Company. See “Transactions with Related Persons.” Since January 2005, Mr. Lynch hassince September 2017. Ms. Egan founded, and served as Chief Executive Officer (“CEO”) of Gatheredtable, a consumer software as a service (“SAAS”) company offering customized meal planning, from 2013 until the Senior Managing Directortechnology platform was sold to a strategic buyer in 2018. From 2010 to 2012 Ms. Egan served as Head of Mill Road Capital Management LLC,Global Strategy and Corporate Development for Starbucks Corporation (Nasdaq: SBUX), a private equity firm he founded that is headquartered in Connecticut. Mr. Lynch previously foundedglobal coffee retailer. At Starbucks, Ms. Egan partnered with the senior leadership team to develop and execute corporate strategy, and led many successful strategic initiatives focusing on cost reduction, developing markets, digital and food. Ms. Egan was a managing director of the private equity firm Lazard Capital Partners. He also was previously employed as a Managing Director of private equity at the BlackstoneThe Boston Consulting Group and as a senior consultant at the Monitor Company, a strategic consulting firm. Mr. Lynch’s extensive experience as a director includes currently serving as chairman of the board of directors of Rubio's Restaurants, Inc.(“BCG”), a privately held restaurant company controlled by Mill Roadglobal management consulting firm from 1997 to 2010 where she partnered with CEO’s and as a director of Panera Bread Company. He previously served as a director of Physicians Formula Holdings, Inc., a public cosmetics company and has also served on numerous other private and not-for-profit boards of directors. Mr. Lynch earned his Bachelor’s degree with honorsleading consumer brands to conceive and successfully drive aggressive growth strategies. While at BCG, she was a frequent global speaker on consumer-centric growth, and was featured in Political Economymany news outlets, including The Wall Street Journal and PhilosophyThe New York Times. Ms. Egan also serves on the Board of Directors of American Campus Communities (NYSE:ACC) where she serves on the strategic planning committee. Ms. Egan holds a BA from WilliamsBarnard College, a MasterColumbia University, an MSEd from Bank Street Graduate School of Philosophy degreeEducation and an MBA from Oxford University and a Master ofColumbia Business Administration degree from Stanford University. Mr. LynchSchool. Ms. Egan brings to our Board a broad range of Directors significant experience in the fast casual segment of the restaurant industry, including public company experience.consumer-centric growth strategy and execution, as well as marketing and brand expertise.

Robert Hartnett joinedhas been a member of our Board of Directors and became Chairman insince July 2016. He has over 40 years of restaurant industry experience. Most recently he served as Chief Executive OfficerCEO for Houlihan’s Restaurants, Inc. (“Houlihan’s”), a national operator and franchisor of fine dining and casual dining restaurants, a position that he held from 2001 until successfully negotiating the sale of that company in 2015. During his tenure at Houlihan’s, Mr. Hartnett successfully re-invented and revitalized the Houlihan’s brand. Prior to joining Houlihan’s, Mr. Hartnett served as President, CEO and Chairman of Einstein/Einstein Noah BagelRestaurant Group Inc. (“Einstein’s”), a then publicly traded company with more than 500 Einstein Bros.national operator and Noah’s New York Bagels restaurants across 27 states.franchisor of fast casual bagel restaurants. In addition, he has owned and operated Einstein Bros. and Boston Market franchise restaurants and has served as President of Bennigan’s Restaurants, a multi-unit casual dining operator. Mr. Hartnett holds a BA in Accounting from Lamar University. Mr. Hartnett brings to our Board of Directors a wealth of experience in restaurant operations and restaurant brand development.

Continuing Directors

François Dufresne has been a member of our Board of Directors since March 2016. Mr. Dufresne joined Public Sector Pension Investment Board (“PSP Investments”) as a Senior Director, Private Equity in January 2016. Argentia Private Investments Inc. (“Argentia”) is a wholly owned subsidiary of PSP Investments and is an affiliate of the Company because, they, together with L Catterton, own more than 50% of our capital stock and we entered into a stockholders agreement with them. These arrangements, pursuant to which Mr. Dufresne was selected as a member of our Board of Directors, are discussed further in the “Transactions with Related Persons” section of this Proxy Statement. From August 2013 to March 2015, he was Vice President Corporate Development and Chief Financial Officer at Ovivo Inc., a Montréal-based company listed on the TSX that designs and delivers conventional to highly technological water treatment solutions for the industrial and municipal markets around the world. From 2002 to June 2013, Mr. Dufresne was a Partner at Ernst & Young LLP in Canada. From 1997 to 2002, he was Vice-President Corporate Development at Telesystem International Wireless Inc., a Montréal-based company listed on NASDAQ and on the TSX that operated wireless voice and data networks in several markets outside of North America, including Brazil, Czech Republic and Romania. Prior to that, Mr. Dufresne spent 11 years at Arthur Andersen, the last four years as a Partner. He holds a law degree (LL.B., 1982) from Université Laval and a Master’s Degree in Taxation (M.Fisc., 1987) from Université de Sherbrooke. Mr. Dufresne brings to our Board of Directors public company and international experience, as well as overall financial, corporate and strategic development experience.

Jeffrey Jones has been a member of our Board of Directors since September 2013.2013 and he has served as Chairman since September 2019. Prior to becoming Chairman, Mr. Jones served as our lead independent director. From 2003 to 2012, Mr. Jones served as the Chief Financial Officer (“CFO”) for Vail Resorts, Inc. (NYSE: MTN), a publicly held resort management company, and also served as a member of the board of directors of Vail Resorts, Inc. from 2008 through 2012. In addition, later in his tenure at Vail Resorts, Inc., Mr. Jones served as President - Lodging, Retail and Real Estate. Mr. Jones is currently a member of the board of directors of Hershey Entertainment and Resorts, where he chairsis the lead independent director and is the chair of the audit and finance committee and is a member of the compensation committee; andcommittee, Summit Hotel Properties, Inc. (NYSE:INN), where he is the lead independent director and chair of the audit committee and a member of the compensation committee, and governance committees.ClubCorp. He is also a member of the US Bank Advisory Board and is a member of the board at the Leeds School of Business, University of Colorado at Boulder. Prior to joining Vail Resorts, Mr. Jones held Chief Financial OfficerCFO positions with Clark Retail Enterprises and Lids Corporation. Mr. Jones received a BA in Accounting and American Studies from Mercyhurst CollegeUniversity (f/k/a Mercyhurst College) and is a member of the AICPA. Mr. Jones brings to our Board of Directors significant public and private company experience in financial positions including significant audit committee roles, as well as overall financial, operations and strategic development experience. Additionally, his board experience includes significant audit committee roles.

Drew Madsen has been a member of our Board of Directors since September 2017. From May 2015 to December 2016 Mr. Madsen served as President of Panera Bread Company, a national operator and franchisor of fast casual bakery cafés, where he helped guide the brand to industry leadership positions in clean food, digital ordering/payment and delivery. From October 2014 to March 2015 Mr. Madsen was President and Chief Operating Officer of the Norwegian Cruise Line division of Norwegian Cruise Line Holdings Ltd. From 2005 to 2013 he was President and Chief Operating Officer, and a member of the board of directors, of Darden Restaurants, Inc. Mr. Madsen began his career at General Mills with various positions in brand management including serving as Vice President of Marketing. He holds an MBA with Distinction from the University of Michigan and earned a bachelor’s degree, magna cum laude, from DePauw University, where he was a member of the Phi Beta Kappa Society. Mr. Madsen brings to our Board significant experience in restaurant operations and brand management.

Andrew Taub joinedhas been a member of our Board of Directors insince December 2010. Mr. Taub is a Managing Partner at L Catterton. He joined Catterton, L Catterton’s predecessor,Catterton in 1996 and has previously served as a Vice President and Principal prior to becoming a Partner in the firm. L Catterton ishas been an affiliate ofinvestor in the Company because, they, together with Argentia, own more than 50% of our capital stock and we entered into a stockholders agreement with them. These arrangements, pursuant to whichsince 2010. Mr. Taub was

selected as a member of our Board of Directors arepursuant to a stockholder agreement which is discussed further in the “Transactions with Related Persons” section of this Proxy Statement. Mr. Taub has helped capitalize and grow over a dozen consumer companies, including restaurants, retail, food and beverage

and marketing services. Prior to joiningL Catterton, he spent three years as Vice President of Nantucket Holding Company, a merchant bank specializing in the acquisition and management of troubled companies, as well as the consolidation of fragmented industries. Previously he worked in Mergers and Acquisitions at Dean Witter Reynolds and Coopers & Lybrand. Mr. Taub received a BA from the University of Michigan and an MBA from Columbia Business School. Mr. Taub brings to our Board of Directors expertise in the retail and consumer industry.

Dave Boennighausen has served as our Interim Chief Executive OfficerCEO since June 2017 and as interim CEO from July 2016 and our Chief Financial Officer since July 2012.through June 2017. He becamehas been a member of our Board of Directors insince August 2015. Mr. Boennighausen served as our CFO from July 2012 through his appointment as permanent CEO in June 2017. He has held various roles at the Company, including Vice President of Finance from October 2007 to March 2011 and our Executive Vice President of Finance, from April 2011 to February 2012.since joining the Company in 2004. He began his career with May Department Stores. He received a BS in Finance and Marketing from Truman State University and holds an MBA from the Stanford Graduate School of Business.Business and received a BS degree in Finance and Marketing from Truman State University. Mr. Boennighausen brings to our Board of Directors leadership skills, financial experience and strategic guidance.

Scott DahnkeElisa Schreiber has been a member of our Boardboard of Directorsdirectors since September 2011. Mr. DahnkeDecember 2019. Since December 2014, Ms. Schreiber has served as the marketing partner at Greylock Partners, an early-stage venture capital firm headquartered in Silicon Valley, where she supports the firm’s portfolio companies with strategic marketing and communications counsel as they scale from seed stage to publicly-traded. From 2010 to 2013, Ms. Schreiber led the global communications team at Hulu, a premium entertainment streaming service, during a period of hyper-growth for the company. Ms. Schreiber is on the Global Co-CEOadvisory board for All Rise, a non-profit dedicated to accelerating the success of L Catterton. Prior to becoming Global Co-CEOfemale funders and founders in 2016, Mr. Dahnke had been a Managing Partnertechnology by improving the success of L Catterton since 2003, and has a broad range of business experience in private equity, consulting, management and finance. L Catterton is an affiliate of the Company because, they, together with Argentia, own more than 50% of our capital stock and we entered into a stockholders agreement with them. These arrangements, pursuant to which Mr. Dahnke was selected as a member of our Board of Directors, are discussed furtherwomen in the “Transactions with Related Persons” section of this Proxy Statement. Prior to joining Catterton, he was a Managing Director at Deutsche Bank Capital Partners and at AEA Investors, where he led AEA’s consumer products investing efforts. Previously, Mr. Dahnke was the Chief Executive Officer of infoUSA, a leading publicly traded provider of business and consumer marketing products and services. Prior to joining infoUSA, Mr. Dahnke served clients on an array of strategic and operational issues as a Partner at McKinsey & Company. His early career also includes experience in the Merger Department of Goldman, Sachs & Co. and with General Motors. Mr. Dahnke received a BS, magna cum laude, in Mechanical Engineeringventure-backed tech ecosystem. Ms. Schreiber earned her MBA from the University of Notre Dame. He also received academic honors while earning an MBA fromSouthern California Marshall School of Business, as well as her BA in Communications & Media Studies and her BA in Visual Arts at the Harvard Business School. Mr. DahnkeUniversity of California, San Diego. Ms. Schreiber brings extensive business experience in marketing and communications, with particular emphasis on emerging technologies, to our Board of Directors expertise in the retail and consumer industry.Board.

|

|

| The Board of Directors recommends a vote FOR the election of each of the Class I director nominees listed above. |

Directors and Corporate Governance

Board Composition

Our Board of Directors currently consists of eightseven members.

In accordance with the amended and restated certificate of incorporation and the amended and restated bylaws, our Board of Directors is divided into three classes with staggered three-year terms. The authorized number of directors may be changed pursuant to the Company’s bylaws by resolution of the Board of Directors. Our directors are divided among the three classes as follows:

Current Class I directors are Johanna MurphyMary Egan and Thomas Lynch,Robert Hartnett, whose termterms will expire at the 2017 annual meeting of stockholders. As described above, Ms. Murphy has decided not to stand for re-election at this Annual Meeting.Meeting of Stockholders.

Current Class II directors are François Dufresne, Jeffrey Jones, Drew Madsen and Andrew Taub, whose termterms will expire at the 2018 annual meeting of stockholders.2021 Annual Meeting.

Current Class III directors are Dave Boennighausen Scott Dahnke, and Robert Hartnett,Elisa Schreiber, whose termterms will expire at the 2019 annual meeting2022 Annual Meeting of stockholders. However, as described above, Mr. Hartnett was nominated by the Board to stand for election as a Class I director at the Annual Meeting. To facilitate his election as a Class I director, Mr. Hartnett has notified the Board of his intention to resign as a Class III director effective and contingent upon his election as a Class I director at the Annual Meeting.

Stockholders.Directors for a particular class will be elected for three-year terms at the annual meeting of stockholders in the year in which their term expires. As a result, only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal.

Board Independence

Under the listing requirements and NASDAQNasdaq rules, independent directors must comprise a majority of a listed company’s Board of Directors. Our Principles of Corporate Governance (the “Principles”) provide that an “independent” director is a director who meets the NASDAQNasdaq definition of independence and the Principles also provide that, under applicable NASDAQNasdaq rules, the members of each of the Audit and Compensation Committees are subject to additional, heightened independence criteria applicable to directors serving on these committees. Our Board of Directors has undertaken a review of its composition, the composition of its committees and the independence of each director (both generally, and, where applicable, under heightened independence criteria applicable to certain committees). Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined, based on the recommendation of our Nominating and Corporate Governance Committee, that each of Messrs. Dahnke, Dufresne, Hartnett, Jones, LynchMadsen and Taub, Ms. Egan and Ms. Murphy isSchreiber was “independent” under NASDAQ rules andNasdaq rules. In addition, the Board determined that each of Messrs. Stuart Frenkiel (who resigned fromScott Dahnke, Francois Dufresne and Thomas Lynch, each of whom served on the Board in February 2016) and Rand was “independent”during a portion of 2019, were independent during the time heperiod they served on our Board of Directors.the Board. In making the independence determinations, our Board of Directors assessed the current and prior relationships thatof each non-employee director has with us and all other relevant facts and circumstances, including the beneficial ownership of our capital stock by each non-employee director.director and Messrs. Dahnke’s, Taub’s and Dufresne’s affiliations with equity investors in the Company. Based on these assessments, for each director deemed to be independent, our Board of Directors made a determination that, because of the nature of the director’s relationships and/or the amounts involved, each director deemed to be independent had no relationships with our company or our management that, in the judgment of the Board, would impair the director’s independence.

Messrs. Dufresne and Dahnke are currently members of the Compensation Committee and are affiliated with Argentia and L Catterton, respectively. Pursuant to applicable SEC and NASDAQ requirements, the Board of Directors considered all factors specifically relevant to determining whether either of these directors had or has a relationship which is material to that director’s ability to be independent from management in connection with their duties as members of the Compensation Committee, including these affiliations, and the Board determined that these directors are independent for purposes of serving on the Board of Directors and its Compensation Committee.

Leadership Structure

The Board does not have a policy regarding the separation of the roles of Chairman and Chief Executive Officer (the “CEO”)CEO and believes that it is in the best interest of the Company and its stockholders for the Board periodically to evaluate and make a determination regarding whether or not to separate the roles of Chairman and CEO based upon the circumstances.

The Company had a combined Chairman and CEO position for the past eight years, and the Board believed that such structure was appropriate in light of the then-CEO’s long tenure with the Company and his familiarity with the Company’s business and industry. However, in connection with the resignation of Kevin Reddy from his position as CEO and Chairman of the Board on July 25, 2016, the Board has reviewed its leadership structure and has determined that separating the roles of Chairman and CEO is the most effective leadership structure for the Company at this time. As such, the Board appointed Dave Boennighausen as the Company’s interim CEO (in addition to his role as the Company’s Chief Financial Officer) and Robert Hartnett as the non-executive Chairman of the Board. The Board believes that the separation of Chairman and CEO duties allows Mr. HartnettJones, who serves as our Chairman, to better focus on active leadership of the Board, and oversight of management, while allowing Mr. Boennighausen to better focus on day-to-day operations of the Company and corporate strategy. In addition, the Board believes that its leadership structure as described above provides an effective framework for addressing the risks facing our company, as discussed in greater detail below under “The Board’s Role in Risk Oversight.”

Among others, the Chairman’s duties and responsibilities include:

presiding at meetings of the Board and stockholders;

facilitating communication between the Board and the Company’s management;

assisting the CEO in formulating long-term strategy;

coordinating agendas and schedules for Board meetings, information flow to the Board and other matters pertinent to the Company and the Board;

presiding at executive sessions of the independent directors; and

being available for consultation and communication with major stockholders as appropriate.

Executive Sessions of Independent Directors

In order to promote open discussion among independent directors, our Board of Directors has a policy of conducting executive sessions of independent directors during each regularly scheduled Board meeting and at such other times as may be requested by an independent director. These executive sessions are chaired by our independent Chairman. Our independent Chairman provides feedback to our Chief Executive Officer,CEO, as needed, promptly after theeach executive session.

Principles of Corporate Governance

Our Principles of Corporate Governance are available on our website at investor.noodles.com/corporate-governance.cfm.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our officers and employees, including our Interim Chief Executive OfficerCEO and Chief Financial OfficerCFO and those officers and employees responsible for financial reporting. We have also adopted a director code of business conduct and ethics that applies to our directors. Our codes of business conduct and ethics are posted on the investor relations section of our website at investor.noodles.com. We intend to disclose future amendments to our codes of business conduct and ethics, and any waivers of their provisions that we grant to our executive officers and directors, on our website within four business days following the date of the amendment or waiver.

Anti-Hedging Policy

The Company’s Insider Trading Policy provides that directors, officers and employees of the Company may not engage in: (a) short-term trading (generally defined as selling Company securities within six months following a purchase); (b) short sales (selling Company securities the seller does not own); (c) transactions involving publicly traded options or other derivatives, such as trading in puts or calls in Company securities; or (d) hedging transactions. The foregoing restrictions also apply to immediate family members of directors, officers and employees, which consist of any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law and any person (other than a tenant or employee) sharing the household of the director, officer or employee.

Board Meetings

During 2016,2019, the Board of Directors held foursix meetings. Each director then servingof our directors attended at least 75% of the aggregate of the total number of meetings of the Board of Directors held during the period in 2019 that such director served and the total number of meetings held by any of the committees of the Board of Directors on which such director served during such period.

The Board’s Role in Risk Oversight

The Board of Directors oversees the Company’s risk management process. The Board oversees a Company-wide approach to risk management, designed to enhance stockholder value, support the achievement of strategic objectives and improve long-term organizational performance. The Board determines the appropriate level of risk for the Company generally, assesses the specific risks faced by the Company and reviews the steps taken by management to manage those risks. The Board’s involvement in setting the Company’s business strategy facilitates these assessments and reviews, culminating in the development of a strategy that reflects both the Board’s and management’s consensus as to appropriate levels of risk and the appropriate measures to manage those risks. Pursuant to this structure, risk is assessed throughout the enterprise, focusing on risks arising out of various aspects of the Company’s strategy and the implementation of that strategy, including financial, legal/compliance, operational/strategic, health and safety, and compensation risks. The Board also considers risk when evaluating proposed transactions and other matters presented to the Board, including acquisitions and financial matters.

While the Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk

in certain specified areas. In particular, the Audit Committee reviews and discusses the Company’s practices with respect to risk

assessment and risk management. The Audit Committee also focuses on financial risk, including internal controls, and discusses the Company’s risk profile with the Company’s independent registered public accounting firm. In addition, the Audit Committee oversees the Company’s compliance program with respect to legal and regulatory requirements, including the Company’s codes of conduct and policies and procedures for monitoring compliance. The Audit Committee also receives regular reports on the Company’s cybersecurity compliance and risk management practices, including its compliance with the Payment Card Industry (PCI) Data Security Standard (DSS), its implementation of data security solutions and risk evaluation, and its insurance coverages. The Compensation Committee periodically reviews compensation practices and policies to determine whether they encourage excessive risk taking, including an annual review of management’s assessment of the risk associated with the Company’s compensation programs covering its employees, including executives, and discusses the concept of risk as it relates to the Company’s compensation programs. Management regularly reports on applicable risks to the relevant committee or the Board, as appropriate, including reports on significant Company projects, with additional review or reporting on risks being conducted as needed or as requested by the Board and its committees.

Board Committees

Audit Committee

Our Audit Committee, which met four times in 2016,2019, is currently composed of Mary Egan, Robert Hartnett and Jeffrey Jones, Johanna Murphy and Robert Hartnett.each of whom is a non-employee, independent member of our Board of Directors. Mr. Jones is the Chairman of the Audit Committee and our Audit Committee financial expert, as currently defined under SEC rules. Each member of the Audit Committee meets the requirements for financial literacy under the applicable NASDAQNasdaq rules. All of our Audit Committee members meet the additional, heightened independence criteria applicable to directors serving on the Audit Committee under NASDAQNasdaq rules and SEC rules.

The Audit Committee operates under a written charter, available on our website at investor.noodles.com/corporate-governance.cfm, that satisfies the applicable standards of the SEC and the listing requirements of NASDAQ,Nasdaq, and oversees our corporate accounting and financial reporting process. The Audit Committee conducts its activities in a manner designed to emphasize the importance of an environment that supports integrity in the financial reporting process.

The Audit Committee’s responsibilities include, but are not limited to:

appointing, compensating, retaining and overseeing our independent registered public accounting firm;firm and evaluating its performance;

approving in advance all audit and permissible non-audit services to be provided by the outside auditor, and establishing policies and procedures for the pre-approval of audit and permissible non-audit services to be provided by the outside auditor;

at least annually, reviewing the independence of the outside auditor;auditor and, consistent with rules of the Public Company Accounting Oversight Board (“PCAOB”), obtaining and reviewing reports by the outside auditor describing any relationships between the outside auditor, and the Company or individuals in financial reporting oversight roles at the Company, that may reasonably be thought to bear on the outside auditor’s independence and discussing with the outside auditor the potential effects of any such relationships on independence;

at least annually, obtaining and reviewing a report by the outside auditor describing, among other things, its internal quality-control procedures;

meeting to review and discuss with management and the outside auditor the annual audited and quarterly financial statements of the Company and the independent auditor’s reports related to the financial statements;

receiving reports from the outside auditor and management regarding, and reviewing and discussing the adequacy and effectiveness of, the Company’s internal controls, including any significant deficiencies in internal controls and significant changes in internal controls reported to the Audit Committee by the outside auditor or management;

receiving reports from management regarding, and reviewing and discussing the adequacy and effectiveness of, the Company’s disclosure controls and procedures;

reviewing and discussing earnings press releases, and corporate practices with respect to earnings

press releases and financial information and earnings guidance provided to analysts;

overseeing the Company’s compliance program with respect to legal and regulatory requirements, including the Company’s Codes of Business Conduct and Ethics and the Company’s policies and procedures for monitoring compliance;

reviewing and discussing the Company’s practices with respect to risk assessment and risk management;

establishing and overseeing procedures for handling reports of potential misconduct; and

establishing and periodically reviewing policies and procedures for the review, approval and ratification of related party transactions.

Compensation Committee

Our Compensation Committee, which met foursix times in 2016,2019, is currently composed of Scott Dahnke, François DufresneRobert Hartnett, Jeffrey Jones and Jeffrey Jones,Drew Madsen, each of whom is a non-employee, independent member of our Board of Directors. Mr.Scott Dahnke and Francois Dufresne began servingserved as members of the Compensation Committee in 2019 until the 2019 Annual Meeting of Stockholders on the CommitteeMay 15, 2019 and until his resignation from our Board on March 4, 2016.2019, respectively. Mr. Hartnett serves as Chairman of the Compensation Committee. The Compensation Committee operates under a written charter, available on our website

at investor.noodles.com/corporate-governance.cfm, that satisfies the applicable standards of the SEC and NASDAQ.Nasdaq. The Compensation Committee’s responsibilities include, but are not limited to:

overseeing the Company’s overall compensation philosophy, policies and programs, and assessing whether the Company’s compensation philosophy establishes appropriate incentives for management and employees;

reviewing and approving corporate goals and objectives relevant to the compensation of the Chief Executive Officer,CEO, evaluating the Chief Executive Officer’sCEO’s performance in light of those goals and objectives, set the Chief Executive Officer’sCEO’s compensation level based on this evaluation, and approve the grant of equity awards to the Chief Executive Officer;CEO;

setting the compensation of other executive officers based upon the recommendation of the Chief Executive OfficerCEO and approve the grant of equity awards to such executive officers;

administering and making recommendations to the Board with respect to the Company’s incentive compensation and equity-based compensation plans that are subject to Board approval;

approving the terms and grant of equity awards for executive officers;

reviewing and approving the design of other benefit plans pertaining to executive officers;

approving, and amending or modifying, terms of other compensation and benefit plans as appropriate;

reviewing and recommending to the Board employment and severance arrangements for executive officers, including employment agreements and change-in-control provisions, plans or agreements;

annually reviewing the compensation of directors for service on the Board and its committees and recommending changes in compensation to the Board as appropriate;

overseeing the assessment of risks related to the Company’s compensation policies and programs; and

annually reviewing an assessment of any potential conflicts of interest raised by the work of any compensation consultants.

Pursuant to the terms of its charter, the Compensation Committee may delegate its duties and responsibilities to one or more subcommittees, consisting of not less than two members of the Committee.

Our Interim Chief Executive Officer, Dave Boennighausen, makes recommendations to the Compensation Committee regarding the compensation of the other executive officers of the Company.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is, or has at any time been, an officer or employee of the Company. None of our executive officers currently serves, or in the past year has served, as a member of the Board of Directors or Compensation Committee of any other entity that has one or more executive officers serving on our Board of Directors or Compensation Committee. No directors served on the Compensation Committee in 20162019 other than Messrs. Dahnke, Frenkiel, Dufresne, Hartnett, Jones and Jones.Madsen. Messrs. Dahnke and Dufresne served on the Board until the 2019 Annual Meeting of Stockholders, in the case of Mr. Dufresne joinedDahnke, and until his resignation on March 4, 2019, in the Compensation Committee in March 2016.case of Mr. Dufresne.

Nominating and Corporate Governance Committee Committee

Our Nominating and Corporate Governance Committee, which met oncefour times in 2016,2019, is currently composed of Messrs. Scott DahnkeMary Egan, Jeffrey Jones and François Dufresne,Drew Madsen, each of whom is a non-employee, independent member of our Board of Directors. Mr.Messrs. Dahnke is the Chairmanand Dufresne served as members of the Nominating and Corporate Governance Committee. in 2019 until the 2019 Annual Meeting of Stockholders, in the case of Mr. Dufresne joinedDahnke, and until his resignation on March 4, 2019, in the case of Mr. Dufresne. Ms. Egan serves as Chairman of the Nominating and Corporate Governance Committee on March 4, 2016.Committee. The Nominating and Corporate Governance Committee operates under a written charter, available on our website at investor.noodles.com/corporate-governance.cfm, that satisfies the applicable standards of the SEC and NASDAQ.Nasdaq. The Nominating and Corporate Governance Committee’s responsibilities include, but are not limited to:

developing and recommending to the Board criteria for Board membership;

assessing the contributions and independence of incumbent directors in determining whether to recommend them for re-election;

identifying, reviewing the qualifications of and recommendingrecruiting candidates for election to the Board;

establishing procedures for the consideration of Board candidates recommended for the Committee’s consideration by the Company’s stockholders;

recommending to the Board the Company’s candidates for election or re-election to the Board at each annual stockholders’ meeting;

recommending to the Board candidates to be elected by the Board as necessary to fill vacancies and newly created directorships;

developing and recommending to the Board a set of corporate governance principles, and annually reviewing those principles and recommending changes to the Board as appropriate;

making recommendations to the Board concerning the size, structure, composition and functioning of the Board and its committees; and

recommending committee members and chairpersons to the Board for appointment.

Policy Regarding Stockholder Recommendations

The Company identifies new director candidates through a variety of sources. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders in the same manner it considers other candidates, as described below. Stockholders seeking to recommend candidates for consideration by the Nominating and Corporate Governance Committee should submit a recommendation in writing describing the candidate’s qualifications and other relevant biographical information and provide confirmation of the candidate’s consent to serve as director. Please submit this information to the Corporate Secretary, Noodles & Company, 520 Zang Street, Suite D, Broomfield, CO 80021, or by email at investorrelations@noodles.com.

Stockholders may also propose director nominees by adhering to the advance notice procedure described under “Stockholder Proposals” elsewhere in this Proxy Statement.

Director Qualifications

The Nominating and Corporate Governance Committee and the Board believe that candidates for director should have certain minimum qualifications, including, without limitation:

demonstrated business acumen and leadership, and high levels of accomplishment;

ability to exercise sound business judgment and to provide insight and practical wisdom based on experience;

commitment to understand the Company and its business, industry and strategic objectives;

integrity and adherence to high personal ethics and values, consistent with our Code of Business Conduct and Ethics;

ability to read and understand financial statements and other financial information pertaining to the Company;

commitment to enhancing stockholder value;

willingness to act in the interest of all stockholders; and

for non-employee directors, independence under NASDAQNasdaq listing standards and other applicable rules and regulations.

In the context of the Board’s existing composition, other requirements, such as restaurant industry experience or experience in a particular business discipline, that are expected to contribute to the Board’s overall effectiveness and meet the needs of the Board and its committees may be considered. The Company values diversity on a company-wide basis and seeks to achieve diversity of occupational and professional backgrounds on the Board, but has not adopted a specific policy regarding Board diversity. We assess qualifications of our directors as part of the Board’s annual self-evaluation process.

The Nominating and Corporate Governance Committee consults with other members of the Board of Directors and with the Company’s management in identifying and evaluating candidates for director.

PROPOSAL NO. 2—ADVISORY (NON-BINDING) VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are providing our stockholders with the opportunity to vote, on an advisory basis, to approve the compensation of the named executive officers (“NEOs”) identified in this Proxy Statement.

Stockholders are urged to review the “Compensation Discussion and Analysis,” “Compensation Committee Report” and “Executive Compensation” sections of this Proxy Statement for more information.

We are asking our stockholders to indicate their support for our NEOs’ compensation by voting FOR the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s proxy statement for the 2020 Annual Meeting pursuant to the compensation disclosure rules of the United States Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosure).”

This is a non-binding advisory vote and, therefore, its outcome does not mandate any particular action. However, our Board and our Compensation Committee will carefully consider the outcome of this vote when making future decisions regarding the compensation of our NEOs. In addition, we expect to hold our next advisory vote to approve the compensation of our named executive officers at the 2021 Annual Meeting of Stockholders.

|

|

| The Board of Directors recommends a vote FOR the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers. |

PROPOSAL NO. 3—RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR 20172020

The Audit Committee of the Board of Directors has selected Ernst & Young LLP, or Ernst & Young, to be the Company’s independent registered public accounting firm for the year ending January 2, 2018,December 29, 2020, and recommends that the stockholders vote for ratification of such appointment. Ernst & Young has been engaged as our independent registered public accounting firm since 2009. As a matter of good corporate governance, the Audit Committee has requested the Board of Directors to submit the selection of Ernst & Young as the Company’s independent registered public accounting firm for 20172020 to stockholders for ratification. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. We expect representatives of Ernst & Young to be present at the Annual Meeting. They will have the opportunity to make a statement at the Annual Meeting if they desire to do so, and will be available to respond to appropriate questions.

Audit and Related Fees

The following table sets forth the aggregate fees for professional services rendered by Ernst & Young for the audit of our financial statements for 20162019 and 2015 and the aggregate fees for other services rendered by Ernst & Young billed in those periods:2018.

|

| | | | | | | | |

| | | 2016 | | 2015 |

Audit fees(1) | | $ | 529,972 |

| | $ | 475,721 |

|

| Audit-related fees | | — |

| | — |

|

Tax fees(2) | | 8,968 |

| | 104,505 |

|

| Total audit and related fees | | $ | 538,940 |

| | $ | 580,226 |

|

|

| | | | | | | | |

| | | 2019 | | 2018 |

Audit fees (1) | | $ | 773,200 |

| | $ | 887,586 |

|

Audit-related fees (2) | | — |

| | — |

|

Tax fees (3) | | 2,640 |

| | — |

|

All other fees (4) | | — |

| | — |

|

| Total fees | | $ | 775,840 |

| | $ | 887,586 |

|

| |

| (1) | 2016Audit fees include the aggregate fees billed for each of the last two fiscal years indicated for professional services rendered by Ernst & Young for the audit of our financial statements, audit of internal control over financial reporting, interim reviews, consents and 2015 audit fees and expensesother services related to the fiscal year auditSEC matters, and interim reviews,related out of pocket expenses, notwithstanding when the fees and expenses were billed or when the services were rendered. |

| |

| (2) | Audit-related fees include the aggregate fees billed for each of the last two fiscal years indicated for assurance and related services rendered by Ernst & Young that are reasonably related to the performance of the audit or review of our financial statements and are not reported under Audit fees. |

| |

| (3) | Tax fees relate toinclude the aggregate fees billed for each of the last two fiscal years indicated for professional services renderedand products provided by Ernst & Young for tax compliance, tax return reviewadvice and preparationtax planning. |

| |

| (4) | All other fees include the aggregate fees billed for each of the last two fiscal years indicated for products and related tax advice.services provided by Ernst & Young, other than the services reported as Audit fees, Audit-related fees or Tax fees. |

The Board of Directors adopted a written policy for the pre-approval of certain audit and non-audit services that Ernst & Young provides. The policy balances the need for independence of Ernst & Young while recognizing that in certain situations Ernst & Young may possess both the technical expertise and knowledge of the Company to best advise the Company on issues and matters in addition to accounting and auditing. In general, the Company’s independent registered public accounting firm cannot be engaged to provide any audit or non-audit services unless the engagement is pre-approved by the Audit Committee. Certain services may also be pre-approved by the Chairman of the Audit Committee under the policy. All of the fees identified in the table above were approved in accordance with SEC requirements and pursuant to the policies and procedures described above.

|

|

The Board of Directors recommends a vote FOR the ratification of the appointment of ERNST & YOUNG LLP for 2017.the year ending December 29, 2020. |

PROPOSAL NO. 3 - APPROVAL OF MATERIAL TERMS OF THE SECTION 162(M) PERFORMANCE GOALS TO BE USED FOR PURPOSES OF THE COMPANY’S AMENDED AND RESTATED 2010 STOCK INCENTIVE PLAN

The Board of Directors recommends that stockholders approve the material terms of the performance goals applicable to awards granted pursuant to the Company’s Amended and Restated 2010 Stock Incentive Plan (the “2010 Plan”). Approval of the material terms of the performance goals is a condition for certain awards made under the 2010 Plan to qualify as fully tax-deductible performance-based compensation under Section 162(m) of the Code.

Section 162(m) places a limit of $1 million on the amount the Company may deduct in any one year for compensation paid to a “covered employee,” which means any person who as of the last day of the fiscal year is the chief executive officer or one of the Company’s three highest compensated executive officers other than the CFO, as determined under SEC rules. There is, however, an exception to this limit on deductibility for compensation that satisfies certain conditions for “qualified performance-based compensation” set forth under Section 162(m). One of the conditions requires stockholder approval every five years of the material terms of the performance goals of the plan under which the compensation will be paid after a “grandfathering” period following an initial public offering that expires at the Annual Meeting.

For purposes of Section 162(m), the material terms of the performance goals include (i) the employees eligible to receive compensation, (ii) a description of the business criteria on which the performance goals are based and (iii) the maximum amount of compensation that can be paid to an employee under the performance goal. Each of these aspects is discussed below.

Summary of Section 162(m) Terms

Eligibility and Participation

Awards may be granted under the 2010 Plan to current or prospective officers of the Company or any subsidiary as well as nonemployee directors and any other service providers who have been retained to provide consulting, advisory or other services to the Company or any subsidiary. As of March 13, 2017, there were seven non-employee directors and approximately 10,900 eligible employees and other service providers eligible to receive awards under the 2010 Plan. The 2010 Plan permits the grant of stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), and incentive bonuses to eligible individuals.

Performance Goals

Under the 2010 Plan, stock options, SARs, restricted stock, RSUs or incentive bonuses may become exercisable or vested based upon the satisfaction of performance goals, as determined by the Compensation Committee of the Board, which may include performance goals based on: total stockholder return; net income; pretax earnings; other earnings-related metrics, including earnings before interest expense, taxes, depreciation and amortization (“EBITDA”); pretax operating earnings measures; operating margin; earnings per share; return on equity; return on capital; return on investment; operating earnings; working capital; revenue or sales-related measures; expenses or expense levels; debt reduction; and cash flow.

Maximum Grants under the 2010 Plan

The plan administrator has the authority in its sole discretion to determine the type or types of awards made under the 2010 Plan. The Compensation Committee has determined that in no event will any participant receive in any calendar year grants of more than 500,000 stock options, 500,000 shares of restricted stock and/or restricted stock units, and/or $2.0 million in incentive bonuses under the 2010 Plan or the Company’s annual incentive bonus arrangements (as described in Proposal No. 4 on page 18 of this Proxy Statement).

Determination of Performance-Based Compensation and Maximum Grants and Awards Under the 2010 Plan

Performance-based compensation will be paid solely on account of the attainment of one or more objective performance goals established in writing by the Compensation Committee while the attainment of such goals is substantially uncertain. Performance goals will be based on one or more business criteria that apply to an individual, a business unit or the Company as a whole, and may be measured on an absolute basis or on a relative basis and on a GAAP or non-GAAP basis, annually or over a period of years. The Compensation Committee is prohibited from increasing the amount of compensation payable if a performance goal is met, but may reduce or eliminate compensation even if such performance goal is attained.

To the extent consistent with Section 162(m) of the Code, the Committee may appropriately adjust any evaluation of performance under a performance goal to (A) eliminate the effects of charges for restructurings, discontinued operations, extraordinary items and all items of gain, loss or expense determined to be extraordinary or unusual in nature or related to the acquisition or disposal of a segment of a business or related to a change in accounting principle, as well as the cumulative effect of accounting changes, in each case as determined in accordance with generally accepted accounting principles or identified in the Company’s financial statements or notes to the financial statements, and (B) exclude one or more of the following events that occurs during a performance period: (i) asset write-downs, (ii) litigation, claims, judgments or settlements, (iii) the effect of changes in tax law or other such laws or provisions affecting reported results, (iv) accruals for reorganization and restructuring programs and (v) accruals of any amounts for payment under an incentive plan or any other compensation arrangement maintained by the Company.

Additional Materials Terms of the 2010 Plan

A summary of other significant terms of the 2010 Plan appears below. The discussion below does not purport to be complete and is subject to, and is qualified in its entirety by, the text of the 2010 Plan. A copy of the 2010 Plan was included as an exhibit to our Form S-1/A filed on June 17, 2013 and can be obtained upon request from the Secretary of the Company.

Purpose

The purpose of the 2010 Plan is to enable the Company and its subsidiaries to attract, retain and motivate directors, members of management and certain other officers and key employees of the Company and its subsidiaries by providing for or increasing their proprietary interest in the Company.

General